Stock Market Breakdown, Part 2, Recession

BY PGFOne month ago, we showed you a pattern that was forming in the stock market that could signal bad times ahead. That pattern appears to have completed signaling deep losses to come in the stock markets. A recession, if the pattern holds, is predicted.

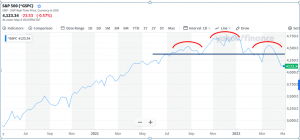

Here is the chart today:

A “Head and Shoulders” pattern has formed, signaling a significant reversal from the prior trend. In English: stocks were going up, now they will go down. The major indexes have already started moving lower. Everything could change when the markets open tomorrow, but the trend has reversed downward.

Couple the pattern with the macroeconomic environment, especially inflation due to wild money printing after the Trump lockdowns, and you have a lousy recipe.

These things take on a life of their own. Every time is different despite the commonalities. This could be the final straw in the 100 years long money changers and war profiteers racket at the central banks. Or, it could be a very mild recession, and soon inflation abates. Momentum has its unique attributes, causing exaggerations both up and down. It could get nasty, and likely will, before it gets better. We just thought you should know.

On May 8, 2022 at 9:59 pm, Robert Orians said:

I was out in the greenhouse planting seeds . it was a warm spring evening about twenty years ago . I was startled to hear the Southern preacher praying for Gawd to bring justice swiftly to America . He briefly brought out our sins . I now have to agree with him . America is ripe for judgement . Bring this harlot down quickly .

On May 9, 2022 at 4:17 am, Joe Blow said:

Agreed.

Those with retirement assets locked up may want to go to cash, asap. Even treasuries won’t be safe. And for love of God don’t buy GLD or SLV.

Income funds and inverse ETFs are the place to be. I own SQQQ!

On May 9, 2022 at 5:46 am, Chris said:

Joe Blow. Curious why not to buy silver or gold?

Tnx,

Chris

On May 9, 2022 at 7:02 am, ragman said:

GLD and SLV are etfs, not physical. The trend is down in the rigged spot prices therefore I’ll wait a while to add to my stash. I only buy 90% US silver coins, not for investment but for insurance. I think the fed is outta airspeed and ideas. Should be a very interesting week!

On May 9, 2022 at 11:10 am, Joe Blow said:

Yes Chris, what ragman said…

I did not say don’t buy gold and silver. I said don’t plow your retirement assets into GLD and SLV (because they market those paper atrocities as real metal). Those 2 in particular, will be proven hollow. I own CEF for my allotment of precious metals in my 401k account. Sprott provides 3rd party audits and individual bar serial numbers. I know what I own shares of.

On May 9, 2022 at 6:24 pm, Dun said:

You’re all still wrapped up in the government stock market. Get out and get out of your heads that it’s actually worth anything.

Physical gold and silver is tangible money; it can be used for barter no matter what happens.

It’s price is not in dollars but other tangibles.

Your IRA’s, retirement accounts and pensions can become worthless overnight.

Prepare accordingly.

On May 9, 2022 at 8:12 pm, Chris said:

Copy that all, and thankee!

Chris