Romans 3:10-26 (Psalm 10:6-7, Isaiah 59:7-8)

I went to a Buc-ee’s. It’s quite an operation. One leaves trying to wrap their mind around what is or is not America and wondering what will become of us. The gas was 10 cents higher than the other stations on the Interstate, but nobody seemed to care or notice; it’s a Buc-ee’s, so presumably, that makes it worth it. Without exaggeration, this one must have more than 100 gas pumps, every lane full; cars, SUVs, or pickups with boomers dragging a fifth wheel.

I’m not sure what the attraction is. The people seem to be there only to be there. Everything was slightly overpriced, and although the food looked pretty good, it was only gas station food. But Buc-ee’s is more than a gas station; it’s a relationship. The BBQ sam’mich was going as fast as they could make them by the dozen.

The lady at the checkout, local as they come, said it’s flat out, non-stop; there must be thousands of people coming and going every day. They’ll pay you $20 an hour to work the overnight shift. She seemed a little slow, but professing Christ, she’s my sister and probably has a more faithful love for the Saviour than I’ll ever know. All some need is a crumb from the Master’s table (Matthew 15:27). God rarely calls those from the high lofts – if that’s you, salvation is no small gift; don’t waste it (Luke 12:47-48).

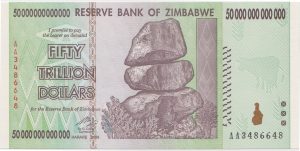

It’s hard to know if the people going there don’t care about inflation and the state of things in the world, or perhaps that’s the point of stopping at a Buc-ee’s on your road trip; to forget the world. There was no sense at all of the death of America or the irony of the place as a symbol and type of the commoditization of the consumer being a nail in the coffin of the West by ending the tangible work of making and building things. The country’s going to hell, actual, but hey, let’s head to the Buc-ee’s out by the Interstate!?!

There’s a section for T-shirts and hats and Buc-ee’s gear. No, I didn’t get a Buc-ee’s T-shirt. Maybe a twinge of regret since I’m not against self-deprecating humor. An area with very overpriced “local” stuff with a State or nearby tourist attraction theme to it. Many self-serve soda dispensers with Buc-ee’s brand of cola, root beer, orange, and the like. They make their own dessert fudge right there and have other areas with things like that. And, of course, a section of regular snacks like Cheeto’s and Coke in a can for those who need a known degree of danger to their health delivered in a familiar size, shape, and color.

On private property, which sole purpose is to make money, it’s often a tricky business, pretending to browse while not angering a money spender. I was quite the novelty among those from far-flung midwestern and northeastern states. A real live Christian, openly discussing salvation in Christ Jesus and handing out literature about the human soul’s condition and relationship to its Creator. A real oddity, curious looks of wonder all around. Christians really exist, rare, but we saw one at the Buc’ee’s, didn’t we, honey, and it asked me about heaven.

“There is none that understandeth, there is none that seeketh after God.” – Romans 3:11

There is none righteous, no, not one. Nobody understands; none seek God, for it’s the Almighty that calls to them and draws them and makes the previously unaware begin to see His purposes; nobody seeks God but that God reveals Himself. You can talk at the Buc-ee’s to a midwestern tourist all day long about Christ, but they can’t hear you until God speaks to them.

“There is no fear of God before their eyes.” – Romans 3:18

Holy God stands before all men, observing their every thought and deed, but neither can they see Him. So few now care for the things of the Almighty or ever consider His ways. How does a civilization turn Godless and survive?

And so America tells itself what is said by all those about to suffer a fall: “He hath said in his heart, I shall not be moved: for I shall never be in adversity.” – Psalm 10:6. A fitting verse for an afternoon at the Buc-ee’s, overwhelmed with abundance.

“Whose mouth is full of cursing and bitterness” – Romans 3:14. Compare with: “His mouth is full of cursing and deceit and fraud: under his tongue is mischief and vanity.” – Psalm 10:7

Is that you, a sinner, dead in your trespasses, self-assured yet utterly self-deceived, blind to God? A man can curse God without ever speaking a word.

“15 Their feet are swift to shed blood: 16 Destruction and misery are in their ways: 17 And the way of peace have they not known” – Romans 3:15-17 (see Isaiah 59:7-8). It is an apt description of the American leadership we’ve come to know, realizing they are taking us where almost none but the hopelessly useful idiot dare go.

The place was packed with people, but there was still room to move and browse. Are they conscience, wandering through life, or simply taking a break from the soon-coming and man-made wreckage?

But I did meet a brother in Christ who was missing several front teeth. I know this because I asked him about his eternal station and saw the biggest unashamed smile light up half complex; that man knows Christ, and from what he’s been saved. It never gets old, that smile of the true believer, the blessing of the almighty by His Spirit living in their heart, the wonderfully fearful, and nowadays ever more rare called of God, appointed unto salvation to service of Him. He moved here from England as a child, an Air Force vet, and a good guy. ‘Round these parts, missing teeth don’t mean dumb; that’s just Hollywood.

His Church is a large one, down to about 50 core people as they search for a new Pastor. As hard as that sounds, it appears to be a good thing: find out who’s committed, purge the chaff, gather the dead branches and burn them up, get new leadership, reset, and serve with purpose. He was there just for the spectacle of it all. Neither of us was disappointed.

We talked by a display of beef jerky, a prominent item, being both road food and guy food. It caught my stomach’s attention. I told him we had about forty; that is the core where I go, serving the Lord with consistent purpose. I’m blessed beyond measure to be among folks who love the Lord, seek the lost with the Gospel, work for Christ with purpose of heart and mind, and are training the young. It’s a rare thing where I go, having been to dozens of Churches, many just like the Buc-ee’s, full of tourists who, for the life of their eternal soul, couldn’t explain the purpose or meaning of what their Church exists to accomplish and why they are there or who profits.

Departing from my new friend and heading for the Beef Jerky counter, I got $15, half a pound worth by weight, of the “sweet and spicy,” which was neither sweet nor spicy. And it got eatin’ in the vehicle on the freeway after leaving; this is what one dutifully does with beef jerky on the road. Not dry, somehow, although under spiced, it was pretty tasty. Since they said we couldn’t eat cows anymore, I ate it all ’till I felt a little gurgly in the belly. I still eat dead cows; price is no object if it means one more good ol’ methane-loaded cow fart to make a liberal cry.

I don’t know if America will make it. I suspect not. But my new toothless Buc-ee’s friend and I, we’ll make it. The rest may burn like a roman candle, but we’d like you to know; that you can make it too.

“24 Being justified freely by his grace through the redemption that is in Christ Jesus: 25 Whom God hath set forth to be a propitiation through faith in his blood, to declare his righteousness for the remission of sins that are past, through the forbearance of God” – Romans 3:24-25